Last Updated on February 1, 2026 by admin

In an increasingly digital world, online banking has become an essential tool for managing personal finances with convenience and efficiency.

With the continuous advancement of technology and an increasing demand for digital services, Absa has crafted a platform that meets diverse banking needs across various demographic segments.

Absa Bank, a leading financial institution in Africa, offers a robust online banking platform that empowers customers to access their accounts, make transactions, and utilize various financial services from the comfort of their homes or on the go, without the need to visit a physical branch.

Customers can perform a wide range of financial transactions. These include viewing account balances, transferring funds between accounts, paying bills, and even managing investments.

The platform is designed with user-friendliness in mind, offering an intuitive interface that makes navigation smooth and straightforward for users of all technological proficiencies.

With security being a paramount concern, Absa has integrated robust cybersecurity measures to protect users’ information and transactions, ensuring peace of mind as they engage in online banking activities.

Read: Absa cellphone banking: steps to Register, transfer money and check Balance

Features And Benefits Of Absa Online Banking

Absa Online Banking offers a secure and user-friendly platform for managing your finances anytime, anywhere. Whether you’re an individual or a business, here’s what makes it stand out:

- 24/7 Account Access: View balances, recent transactions, and download statements.

- Payments & Transfers:

- Pay bills and beneficiaries

- Make immediate payments and schedule future ones

- Use CashSend to send money without a card

- Mobile App Integration: Available on iOS and Android for banking on the go

- Cardless ATM Withdrawals: Withdraw cash without your physical card

- Security Tools:

- Biometric login (facial recognition, fingerprint)

- SureCheck verification for transactions

- Ability to limit card usage (online, till-point, or disable)

Benefits

- Convenience: No need to visit a branch—bank from your phone or computer.

- Enhanced Security: Advanced encryption and multi-factor authentication.

- Rewards Program: Earn cashback and redeem Absa Rewards via the app

- Customer Support: Access help through the app or call centre (08600 08600)

- International Access: Use the platform globally with secure login protocols.

Read:How to register for Hsbc online banking and Mobile app

How To Register For Absa Online Banking

Registering for Absa Online Banking is a straightforward process designed to give you convenient access to your finances at any time.

To begin, ensure you have a reliable internet connection and a device like a computer or smartphone. Open your web browser and navigate to the official Absa website. Once there, look for the online banking registration option, often prominently displayed on the homepage.

- Click “Register”: This will take you to the online registration page.

- Enter Your Details:

- ATM card number

- ATM PIN

- ID or passport number

- Email address and mobile number

- Create Login Credentials:

- Choose a strong 5-digit PIN

- Confirm the PIN

- Accept Terms: Read and agree to the Personal Client Agreement.

- Verify with SureCheck: A verification message will be sent to your registered device.

- Complete Registration: Once verified, you’re ready to start banking online

Registering via the Absa Banking App

The Absa Mobile Banking App is designed to make your financial life easier, safer, and more flexible—right from your smartphone. Whether you’re managing personal finances or running a business, here’s what you can expect:

- Instant Payments: Send money with PayShap or CashSend—even without a card

- Card Management:

- Temporarily lock your card

- Replace lost cards quickly

- Retrieve or unblock your PIN

- Prepaid Services: Buy airtime, data, electricity, and even play Lotto

- Account Tools:

- View balances and statements

- Reverse unauthorized debit orders

- Adjust banking limits easily

Benefits

- Free Data Usage: No data charges when using the app on supported networks

- Digital Fraud Warranty: Added protection for all your digital transactions

- Business Banking: Approve payments, check balances, and transact on the go

- Multi-Device Access: Link and manage devices securely with facial biometrics

Read: How to register for Barclay Online Banking and Mobile App

How to register for Absa mobile App

- Download the App: Available on Google Play and the Apple App Store.

- Tap “I’m already with Absa” and select Register for Digital Banking.

- Enter Your ATM Card Number and PIN.

- Confirm Contact Details and accept the verification request.

- Create a 5-digit PIN and Password.

- Done! You’re now registered and can start using the app

How to transfer money from absa online banking

Transferring Money with Absa Online Banking is simple and secure. Whether you’re sending funds to another Absa account, an external bank, or using CashSend, here’s how to do it:

Via Absa Online Banking (Web Platform)

- Visit Absa Online Banking and enter your credentials.

- Go to “Pay”: Click on the Payments tab.

- Choose Recipient:

- Select an existing beneficiary, or

- Click “Pay new beneficiary” to add someone new.

- Enter Payment Details:

- Beneficiary name and account number

- Amount to transfer

- Reference (optional)

- Notification method (SMS or email)

- Select Payment Type:

- Immediate

- Scheduled

- Recurring

- Verify & Confirm:

- Review the details

- Accept the disclaimer

- Complete verification via SureCheck

- Click Accept to finalize

Via Absa Mobile App

- Open the App and log in securely.

- Tap “Pay” and choose:

- Existing beneficiary

- New beneficiary

- Fill in the payment info and select Immediate Payment.

- Confirm and verify using SureCheck or biometrics.

Using CashSend (No Card Needed)

- Available on both the app and website.

- Send money to someone who can withdraw it at an Absa ATM using a secure PIN.

International Transfers

- Use the SWIFT payment system via Absa Online Banking.

- You’ll need:

- Beneficiary’s bank details

- Absa’s SWIFT code: ABSAZAJJ

- Supporting documents (if required)

How to reset Absa internet banking and mobile app

Resetting Your Absa Internet Banking and Mobile App Access is easy and secure. Whether you’ve forgotten your password, PIN, or need to re-register your app, here’s how to get back on track:

Reset Your Password

- Go to the Absa Online Banking login page

- Click “Forgot Password”

- Enter:

- Access account number

- User number (usually 1)

- CAPTCHA code

- Accept the verification request sent to your registered device

- Create and confirm your new password

- Done! You can now log in with your updated credentials

Reset Your PIN

- On the login page, click “Forgot PIN”

- Enter your access account number, user number, and CAPTCHA

- Accept the verification request

- Create and confirm your new 5-digit PIN

- You’re good to go

Reset Your Passcode

- Open the app and tap “Forgot Passcode?”

- Tap “Scan face” to verify your identity

- Allow camera access and complete the facial scan

- Create and confirm your new 5-digit passcode

- Tap Done—your passcode is reset

Reset Your Password

- Tap “Forgot Password” on the login screen

- Enter your ID number and follow the prompts

- Complete facial scan verification

- Create and confirm your new password

- You’re back in

How to get bank statement from absa Bank

- How Does Zelle Work? Send And Receive Money - February 16, 2026

- The difference between Checking and Savings Accounts - February 16, 2026

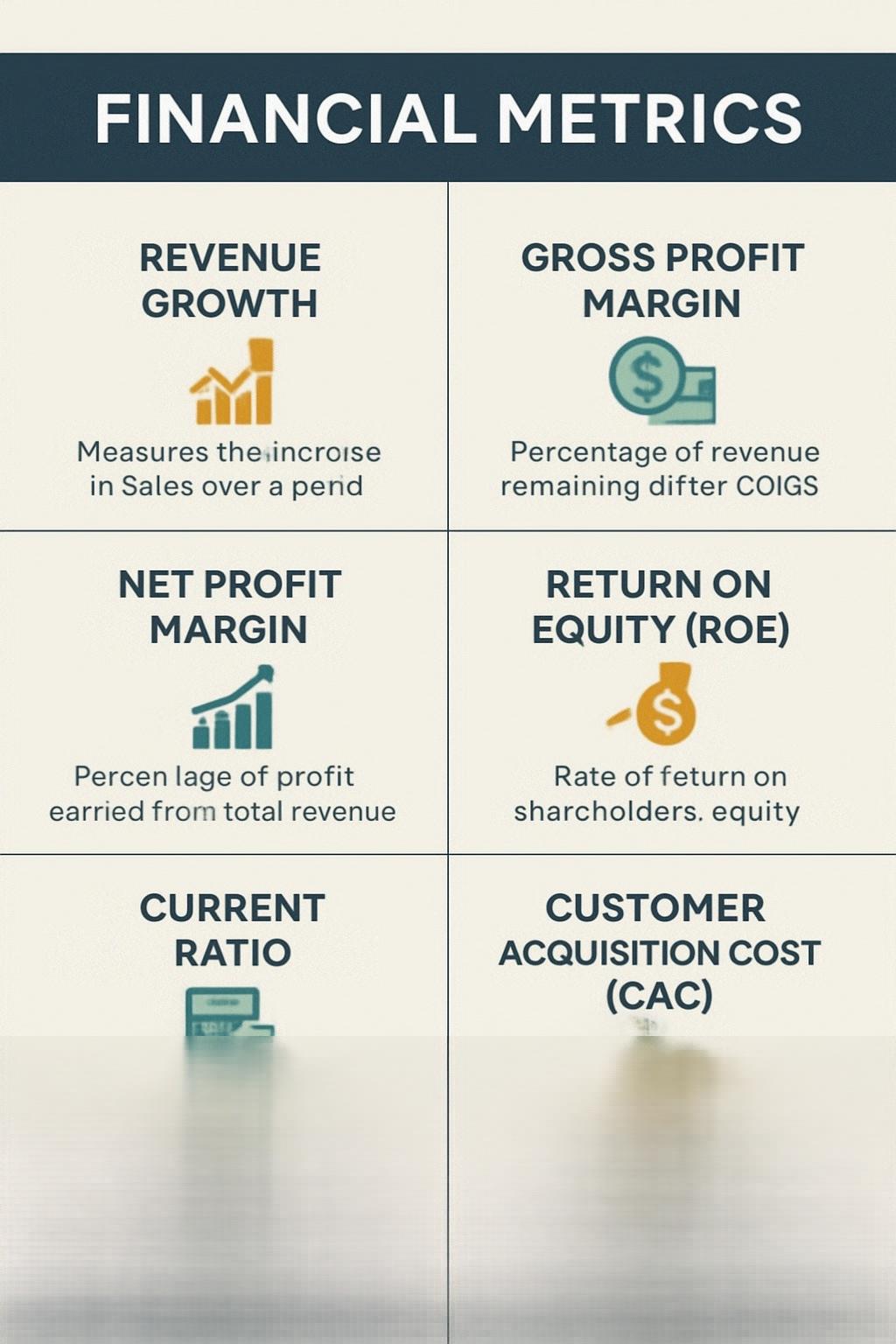

- How to track financial metrics in business - February 13, 2026