Last Updated on April 26, 2024 by admin

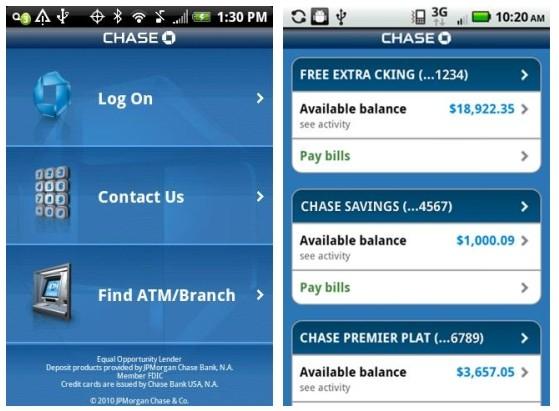

Chase Bank offers a convenient and secure way to manage your finances through its Online Banking platform and Mobile App. In this digital age, having access to your accounts anytime, anywhere is essential, and Chase provides a user-friendly interface for customers to perform various banking tasks at their fingertips

Registering for online banking and mobile app is a simple and convenient process that can be completed in just a few easy steps.

This article will guide you through the process of registering for Chase Online Banking and Mobile App, setting up key features and benefits, exploring the functionalities of the mobile application,

Features and benefits of chase online banking

Chase Online Banking provides a wide range of features and benefits to make your banking experience easier and more efficient. Here’s a breakdown:

Key Features

- Account Management:

- View balances and transaction history across checking, savings, credit cards, and other eligible Chase accounts.

- Search for specific transactions by date, amount, or merchant.

- Transfers:

- Move money between your Chase accounts.

- Send and receive money with Zelle® to friends, family, and others.

- Initiate external transfers to and from accounts at other banks.

- Bill Payments:

- Set up one-time or recurring bill payments for various services.

- Easily track and manage scheduled payments

- Mobile Check Deposit: Deposit checks using your phone’s camera through the Chase Mobile® App.

- Financial Tools:

- Track spending and set budgets with budgeting tools.

- Access your credit score (if eligible) and monitor your credit report for changes.

- Card Management:

- Lock or unlock debit/credit cards for security.

- View spending breakdowns and redeem rewards for eligible credit cards.

- Set travel notifications for your cards.

Benefits

- Convenience: Bank from anywhere, 24/7 with an internet connection.

- Security: Chase takes online security seriously, employing encryption and various security measures to protect your information.

- Efficiency: Perform most common banking tasks quickly and easily compared to in-branch visits.

- Alerts and Notifications: Customize notifications for account activity, payment reminders, and more.

- Financial Insights: Access tools to track your spending, budget effectively, and monitor your credit health.

functions of chase bank online banking

Chase Bank online banking offers a suite of functions to streamline your banking experience. Here’s a breakdown of the key areas:

Account Management

- View Balances and Transactions: See real-time balances for all your linked Chase accounts (checking, savings, credit cards, etc.) and detailed transaction histories.

- Search Transactions: Filter and search for specific transactions using keywords, dates, amounts, or merchant names.

- Download Statements: Access and download your account statements in PDF or CSV formats.

Money Transfers

- Internal Transfers: Move funds instantly between your Chase accounts.

- Zelle® Transfers: Send and receive money quickly and securely with friends, family, or others using their email address or phone number.

- External Transfers: Initiate transfers to and from accounts at other banks.

Bill Payments

- One-Time Payments: Pay bills for various utilities, services, and companies.

- Recurring Payments: Set up automatic payments to ensure your bills are paid on time.

- Payment Management: Track scheduled payments, view payment history, and add or edit payees.

Mobile Check Deposits

- Deposit Convenience: Deposit checks directly to your account using your smartphone’s camera and the Chase Mobile® App.

- Quick Access to Funds: Enjoy faster availability of deposited funds compared to traditional methods.

Financial Tools & Insights

- Budgeting: Track spending, set budgets, and categorize your expenses to manage your money better.

- Credit Score & Monitoring: Access your credit score (if eligible) and get updates and alerts on your credit report.

Card Management

- Lock/Unlock Cards: Temporarily freeze or unfreeze debit or credit cards for security if misplaced or compromised.

- Spending Reports: View spending summaries for your credit cards and redeem rewards on eligible cards.

- Travel Notifications: Inform Chase of your travel plans to avoid potential fraud blocks on your cards.

How to register for chase bank Online

Here’s how you can register for Chase Online Banking:

Method 1: Through the Chase Website

- Go to Chase Website: Visit the Chase website.

- Click Sign Up Now”: Underneath the sign-in fields, you’ll see this option.

- Choose Which type of account would you like to access online?

1.Personal

2.Business

3.Commercial - Enter

-

Enter Social Security number6. Create your username7.Follow the screen to complete the regitration process.

Also read: How to enroll for Wells Fargo Online banking and Mobile App

How can I update my chase mailing address?

- Use the website or app. The steps will vary from bank to bank, but you should at least be required to sign in.

- Call the number on the back of your credit card. …

- Submit an address change by mail. …

- Visit a branch.

How do I register for the Chase bank mobile app?

You don’t need to register specifically for the Chase Mobile® App if you already have Chase Online Banking. Here’s how to get started:

Prerequisites

- Chase Account: You must be an existing Chase customer with a checking, savings, credit card, or other eligible account.

- Online Banking Enrollment: If you haven’t set up Chase Online Banking yet, you’ll need to do that first.

Steps to Download & Sign In

- Download the App:

- Apple Devices: Search for “Chase Mobile” on the App Store.

- Android Devices: Search “Chase Mobile” on the Google Play Store.

- Install: Download and install the official Chase Mobile® App.

- Sign In:

- Launch the app and tap on “Sign In”.

- Use the same username and password that you use for Chase Online Banking.

- Choose “Request an identification code” and if you’d like to get it by email, phone call or text. Enter the code and your password in the app. Then you’re done.

Also read: FCMB bank Internet Banking and Mobile App – How to Register and create Token

How do I transfer money online from a Chase bank

Here’s how to transfer money online from your Chase bank account using Chase Online Banking:

1. Log in to Chase Online Banking: Go to the Chase website and sign in using your username and password.

2. Access the Transfer Menu: Once logged in, navigate to the section for transfers. This might be called “Transfer” or “Move Money” depending on the specific interface of your Chase online banking platform.

3. Choose Transfer Type: Select the type of transfer you want to make.

4. Enter Transfer Details (All Transfer Types):

- Amount: Enter the amount of money you want to transfer.

- Date (Optional): Depending on your needs, you might be able to choose a specific date for the transfer to occur, or it might happen immediately.

5. Review and Submit: Carefully review all the transfer details (source account, destination account, amount, date). Once everything is accurate, confirm the transfer to initiate it.

How to deposit check with chase mobile deposit

Depositing a check using the Chase Mobile® App is simple and convenient. Here’s a step-by-step guide:

Before You Start:

- Endorsement: Sign the back of your check and write “For Mobile Deposit Only at Chase” below your signature.

- Good Lighting: Ensure you’re in a well-lit area to capture clear images of the check.

Deposit Process:

- Open the Chase Mobile® App: Launch the app and sign in.

- Select “Deposit Checks”: Find and tap the “Deposit Checks” option.

- Choose Account: Select the Chase account where you want to deposit the check.

- Enter Amount: Type in the exact amount written on the check.

- Take Photo of the Front: Follow the on-screen prompts.

- Align: Position the check within the guides on the screen.

- Focus: Make sure the image is clear and not blurry.

- Capture: The app may take the photo automatically or provide a “Capture” button.

- Take Photo of the Back: Repeat the same process for the back of your endorsed check.

- Review and Confirm: Verify that the images are clear and the check information (amount) is accurate.

- Submit Deposit: Tap “Submit” or a similar button to finalize the deposit.

How do I make a payment with Chase bank ?

Chase offers you several ways to make payments, depending on whether it’s a bill, a person, or a transfer between your own accounts. Here’s a breakdown of the options:

1. Paying Bills through Chase Online Bill Pay

- Enroll in Bill Pay: If you haven’t already, activate Chase Online Bill Pay through your online banking dashboard.

- Add Payees: Add the company or service you want to pay by providing their billing information.

- Schedule Payments: Set up one-time or recurring payments. Specify the amount and the date the payment should be sent.

- Manage Payments: Track your scheduled payments, payment history, and add or modify payees efficiently.

2 Sending Money to Other People (Zelle®)

- Through Online Banking or App: Navigate to the “Zelle®” section in your online banking or Chase Mobile® App.

- Add Recipient: If it’s your first time, you may need to add the recipient using their email address or US mobile number linked to their Zelle-enabled account.

- Specify Amount and Date: Enter the amount you want to send and choose a transfer date.

- Review and Send: Verify the recipient’s information and confirm the payment.

3. Sending Money to Other Banks

- Within Online Banking: Access the bill pay section in your online banking.

- Add External Payee: If it’s the first time, add a payee by providing the recipient’s name, bank routing number, and account number.

- Schedule the Payment: Input the amount you want to transfer and choose a date.

- Review and Confirm: Check all the details before sending the payment.

You may like to read: How to register for Fidelity bank Online Banking and Mobile app

How to view chase bank current and past statements online?

Here’s how to view your current and past Chase bank statements online:

Through Chase Online Banking

- Log In: Access Chase Online Banking on the Chase website and log into your account.

- Statements & Documents: Locate a section titled “Statements & Documents” or something similar. It might be on the main account dashboard or under a menu or profile tab.

- Select Account: Choose the specific account (checking, savings, credit card, etc.) for which you want to view the statement.

- Choose Statement Period: Select the statement month and year you wish to view. Chase typically makes statements available online for an extended period.

- View and Download: The statement will usually open in PDF format directly in your browser. You should also have the option to download and save it for your records.

Through the Chase Mobile® App

- Open the App: Launch the Chase Mobile® App and sign in.

- Select Account: Tap the account for which you want to view the statement.

- Statements Tab: Look for a tab titled “Statements,” “Documents,” or something similar.

- Choose Period: Select the statement month and year.

- View and Download: Open the statement (usually PDF format) and potentially save it to your device.

How to access Chase Bank account information and activity?

You have two primary ways to access your Chase Bank account information and activity, offering both flexibility and detail:

1. Chase Online Banking

- Website: Log into your Chase Online Banking account

- Overview and Details: Your main dashboard often provides a quick view of account balances and recent activities.

- Account History: Navigate to specific accounts (checking, savings, credit card, etc.) to see detailed transaction history. You can often filter transactions by date, amount, or type.

- Statements: Access and download past and current statements in PDF or CSV formats within the “Statements & Documents” section.

2. Chase Mobile® App

- Download: Get the Chase Mobile® App from the Apple App Store or Google Play Store.

- Sign In: Use your Chase Online Banking credentials to sign in.

- Mirrored Functionality: The app mirrors the capabilities of online banking. Select an account to view balances, recent activity, and in-depth transaction history.

- Convenient Access: Check information on the go from your smartphone or tablet.

Additional Methods (may depend on your account types):

- ATM: Insert your Chase debit card at a Chase ATM and use the menu options to view balances or get a mini-statement.

- Phone Banking: Call Chase customer service and follow prompts to get account summaries via automated service or by speaking to a representative.

Source: Chase bank online banking

- How to Generate first bank Token and activate it - June 29, 2024

- How to Contact wellsfargo Customer Service - May 24, 2024

- PayVIS: New Lagos State platform for paying traffic offense and penalties - May 1, 2024