Last Updated on February 5, 2026 by admin

The United Kingdom hosts a diverse range of commercial banks and building societies, from global giants like Barclays and HSBC to regional institutions such as Yorkshire Building Society. Together, they form the backbone of the UK’s financial system, serving millions of customers with savings, loans, and investment services.

1. HSBC Holdings

HSBC Holdings plc is one of the world’s largest banking and financial services organizations, headquartered in London, with operations spanning Europe, Asia, the Americas, and the Middle East. As of 2025, it continues to position itself as a global leader in retail banking, wealth management, and corporate finance, with a renewed focus on sustainable growth and digital transformation

- Founded: 1865 in Hong Kong and Shanghai.

- Headquarters: London, United Kingdom.

- Global Reach: Operates in more than 60 countries and territories.

- Employees: Over 200,000 worldwide.

- Stock Listings: Primary listing on the London Stock Exchange (LSE: HSBA), also listed in Hong Kong and New York.

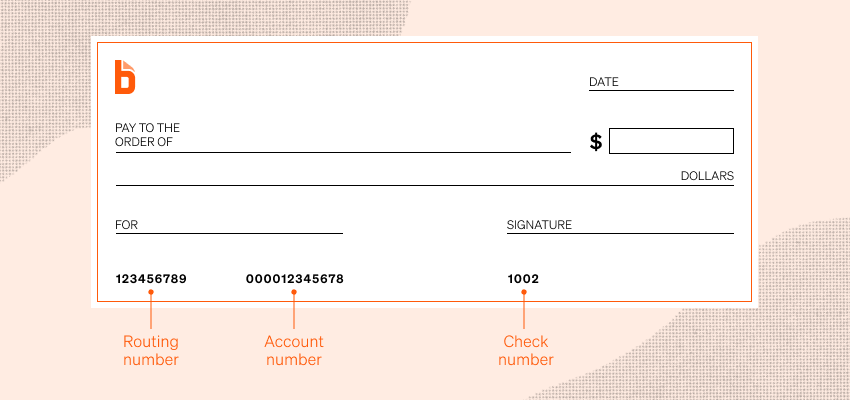

Also read: Routing Numbers vs. Account Numbers: What Sets Them Apart

2. Barclays

Barclays plc is one of the UK’s largest and most influential financial institutions, headquartered in London, with operations across more than 40 countries. As of 2025, it remains a major player in retail banking, investment banking, and wealth management, serving millions of customers worldwide.

- Founded: 1690, making it one of the oldest banks in the world.

- Headquarters: London, United Kingdom.

- Employees: Over 90,000 globally.

- Stock Listings: London Stock Exchange (LSE: BARC) and New York Stock Exchange (NYSE: BCS).

- Global Presence: Operates in Europe, the Americas, Asia, and Africa

3. Lloyds

Lloyds Banking Group plc is one of the UK’s largest financial services institutions, headquartered in London, with a strong focus on retail and commercial banking. As of 2025, it continues to deliver robust financial performance, driven by its purpose of “Helping Britain Prosper” and a strategy centered on digital transformation, customer trust, and sustainable growth.

- Founded: Lloyds traces its origins back to 1765 in Birmingham, though Lloyds Banking Group was formally established in 2009 after the acquisition of HBOS.

- Headquarters: London, United Kingdom.

- Employees: Over 60,000 globally.

- Stock Listing: London Stock Exchange (LSE: LLOY).

- Core Brands: Lloyds Bank, Halifax, Bank of Scotland, Scottish Widows.

4. NatWest Group

NatWest Group plc is one of the United Kingdom’s leading banking and financial services organizations, headquartered in Edinburgh, Scotland. As of 2025, it remains a major force in retail and commercial banking, with a strong emphasis on digital innovation, sustainability, and supporting UK households and businesses.

- Founded: 1968 (as National Westminster Bank), restructured into NatWest Group in 2020.

- Headquarters: Edinburgh, Scotland, United Kingdom.

- Employees: Over 60,000 globally.

- Stock Listing: London Stock Exchange (LSE: NWG).

- Core Brands: NatWest, Royal Bank of Scotland (RBS), Ulster Bank, Coutts (private banking).

5. Standard Chartered

Standard Chartered plc is a London-headquartered multinational bank with a unique focus on connecting the world’s most dynamic markets across Asia, Africa, and the Middle East. As of 2025, it remains a leading provider of corporate, investment, retail, and wealth management services, with a strong emphasis on sustainability and digital transformation.

- Founded: 1969 (through the merger of Standard Bank of British South Africa and Chartered Bank of India, Australia, and China).

- Headquarters: 1 Basinghall Avenue, London, United Kingdom.

- Global Reach: Operates in over 50 countries, with 85% of income and profits generated from Asia, Africa, and the Middle East.

- Employees: Approximately 85,000 worldwide.

- Stock Listings: London Stock Exchange (LSE: STAN) and Hong Kong Stock Exchange.

6. Santander UK

Santander UK plc is a major retail and commercial bank in the United Kingdom, owned by the Spanish banking group Banco Santander. With millions of customers and a strong presence in personal finance, mortgages, and SME banking, it remains one of the country’s most recognized financial institutions.

- Parent Company: Banco Santander S.A. (Spain).

- Headquarters: London, United Kingdom.

- Founded in UK: 2010 (following the merger of Abbey National, Alliance & Leicester, and Bradford & Bingley’s savings business).

- Employees: Over 20,000 in the UK.

- Customers: More than 14 million retail and business clients.

- Stock Listing: Operates as a wholly owned subsidiary, not separately listed on the LSE.

Read: Factors that determine foreign exchange Rate of a country

7. Nationwide Building Society

Nationwide Building Society is the largest building society in the United Kingdom and one of the country’s most trusted financial institutions. As a member-owned mutual, it operates differently from commercial banks, prioritising the interests of its members rather than external shareholders.

- Founded: 1846 (roots trace back to early building societies, formally established as Nationwide in 1966).

- Headquarters: Swindon, Wiltshire, United Kingdom.

- Ownership: Member-owned mutual, meaning customers are also stakeholders.

- Employees: Over 18,000.

- Customers/Members: More than 16 million members, making it the largest building society in the world.

8. TSB Bank

TSB Bank plc is a UK-based retail and commercial bank, known for its strong community focus and commitment to providing straightforward banking services. With roots dating back to the early 19th century, TSB has evolved into a modern institution that emphasises customer trust, digital innovation, and local engagement.

- Founded: 1810 (originally as Trustee Savings Bank).

- Re-established: 2013, following its separation from Lloyds Banking Group.

- Headquarters: Edinburgh, Scotland, United Kingdom.

- Employees: Approximately 6,000.

- Customers: Over 5 million retail and business clients.

- Ownership: Subsidiary of Banco de Sabadell (Spain).

9. Virgin Money UK

Virgin Money UK plc is a prominent retail and commercial bank in the United Kingdom, known for its distinctive brand identity and customer-focused approach. As part of the Virgin Group’s wider portfolio, it combines financial services with the group’s reputation for innovation and bold marketing.

- Founded: Originally launched as Virgin Direct in 1995, later rebranded as Virgin Money.

- Headquarters: Newcastle upon Tyne, United Kingdom.

- Employees: Approximately 7,500.

- Customers: Serves around 6.5 million retail and business clients.

- Stock Listing: London Stock Exchange (LSE: VMUK).

- Core Brands: Virgin Money, Clydesdale Bank, Yorkshire Bank (merged under Virgin Money UK).

10. Metro Bank

Metro Bank plc is a UK-based retail and commercial bank, recognised for its customer-friendly approach and distinctive “community bank” model. Established in 2010, it was the first new high street bank to launch in the UK in over 100 years, aiming to challenge traditional banking with extended branch hours, pet-friendly policies, and a strong focus on customer service.

- Founded: 2010, by Vernon Hill.

- Headquarters: London, United Kingdom.

- Employees: Approximately 3,500.

- Customers: Over 2 million retail and business clients.

- Stock Listing: London Stock Exchange (LSE: MTRO).

- Unique Feature: Known for “stores” rather than branches, designed to be welcoming and accessible.

Which bank is best for student

The best student bank accounts in the UK for 2025 are offered by NatWest/RBS and Santander. NatWest/RBS stands out with the largest overdraft (up to £3,250 interest-free) plus freebies like £85 cash and a 4-year Tastecard, while Santander offers a guaranteed £1,500 overdraft and a free 4-year Railcard, which can save students hundreds on travel.

Best Bank in UK?

| Bank | Strengths | Best For |

|---|---|---|

| HSBC | Global presence, strong wealth management, competitive international services | Expats, international students, global business |

| Barclays | Wide branch network, strong investment banking, digital tools | Professionals, investors, those needing diverse services |

| Lloyds Banking Group | Large UK retail base, strong mortgage and insurance offerings | Families, homeowners, savers |

| NatWest Group | Strong UK focus, good SME support, digital innovation | UK-based students, small businesses |

| Santander UK | Popular student account perks (Railcard), solid retail banking | Students, frequent travelers |

Read: Difference Between Memorandum of Association and Articles of Association

Which bank is the top bank in uk

The top bank in the UK by size and market share is HSBC Holdings plc, which is the largest bank in the UK and Europe, with assets exceeding £180 billion in the UK market as of late 2025. However, the most popular bank by customer numbers is Barclays, serving around 48 million people

- How Does Zelle Work? Send And Receive Money - February 16, 2026

- The difference between Checking and Savings Accounts - February 16, 2026

- How to track financial metrics in business - February 13, 2026