Last Updated on February 16, 2026 by admin

Bank accounts are the foundation of personal finance, but not all accounts serve the same purpose. The two most common types—checking accounts and savings accounts—are designed for different financial needs. Understanding their differences helps you manage money more effectively and make smarter financial decisions.

Core Purpose

- Checking Account: Built for everyday transactions. It’s where your paycheck usually lands and from where you pay bills, swipe your debit card, or withdraw cash.

- Savings Account: Designed for storing money long-term. It helps you build an emergency fund or save for future goals while earning interest.

Read:How to track financial metrics in business

Differences Between Checking and Savings Accounts

Here’s a clear breakdown of the differences between checking and savings accounts:

| Feature | Checking Account | Savings Account |

|---|---|---|

| Purpose | Everyday spending and transactions | Saving money for future needs or emergencies |

| Access to Funds | Unlimited withdrawals, debit card use, checks, and online transfers | Limited withdrawals (often capped monthly), less convenient for daily use |

| Interest Rates | Typically very low or none | Generally higher, helping your balance grow over time |

| Fees | May include monthly maintenance fees, overdraft fees | Often, fewer fees, but may require minimum balances |

| Tools & Features | Debit cards, bill pay, direct deposit, and ATM access | Interest accrual, automatic transfers, sometimes linked to checking |

| Best For | Managing daily expenses like groceries, rent, and bills | Building an emergency fund or saving toward goals |

Checking Accounts

A checking account is one of the most essential financial tools for managing your everyday money. Whether you’re receiving a paycheck, paying bills, shopping online, or withdrawing cash, a checking account makes these transactions simple, secure, and convenient.

It’s designed for everyday financial transactions—paying bills, shopping, and managing income. Unlike savings accounts, checking accounts prioritize accessibility over earning interest

What Most Checking Accounts Offer

- Debit card for everyday purchases

- Check-writing privileges when needed

- Online and mobile banking for easy account management

- ATM access for cash withdrawals

- Direct deposit services for paychecks and recurring income

Read: Annual Percentage Rate (APR):Type, Meaning and How It’s Calculated

Common Types of Checking Accounts

Here’s a clear overview of the common types of checking accounts you’ll find at most banks and credit unions:

| Type | Key Features | Best For |

|---|---|---|

| Traditional Checking | Standard account with debit card, checks, ATM access, and online banking. | Everyday banking needs. |

| Interest-Bearing Checking | Earns interest on balances, often with higher fees or minimums. | Customers who keep higher balances. |

| Student Checking | Low or no fees, flexible requirements, perks for students. | College or high school students. |

| Senior Checking | Tailored benefits like reduced fees, free checks, or discounts. | Older adults are seeking cost savings. |

| Business Checking | Designed for managing business transactions, payroll, and expenses. | Small business owners and entrepreneurs. |

| Rewards Checking | Offers cashback, points, or perks for debit card use. | Customers who want extra value from spending. |

| Second-Chance Checking | Helps rebuild banking history; may have higher fees. | People with past banking issues. |

How to Open a Checking Account

Opening a checking account usually involves:

-

Providing identification (such as a driver’s license or passport)

-

Sharing your Social Security number or tax ID

-

Making an initial deposit (varies by bank)

-

Agreeing to the bank’s terms and conditions

You can open an account in person at a branch or online through the bank’s website or mobile app.

Read: How to Cancel a Credit Card the Right Way

How Money Moves In and Out

Deposits

You can fund your checking account through:

-

Direct deposit (employer payroll payments)

-

Mobile check deposit using a banking app

-

ATM deposits

-

Electronic transfers from another account

-

Cash deposits at a branch

Once deposited, funds are typically available quickly, though some deposits (like large checks) may be subject to holds.

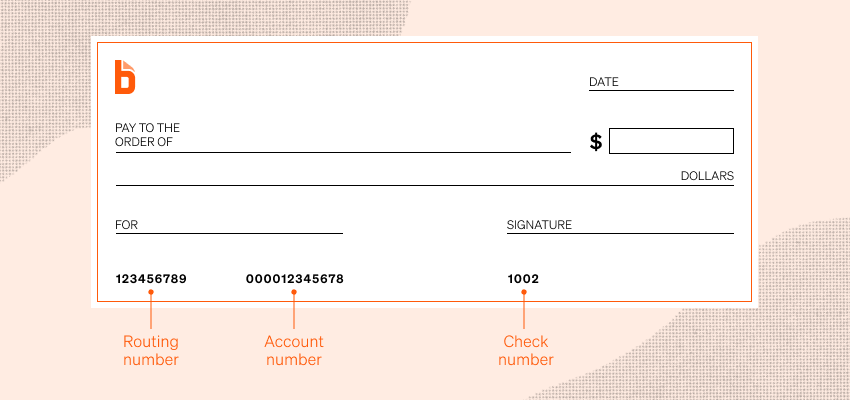

Withdrawals and Payments

You can access your money using:

-

Debit cards for purchases or ATM withdrawals

-

Online bill pay

-

Electronic transfers

-

Checks

-

Wire transfers

Debit cards are often issued by networks such as Visa Inc. or Mastercard, allowing you to make purchases directly from your account balance.

Savings Accounts

A savings account is a bank account designed to help you store money securely while earning interest. Unlike checking accounts, which are used for everyday spending, savings accounts are meant for setting money aside and growing it over time.

Whether you’re building an emergency fund, saving for a vacation, or planning for a major purchase, a savings account is one of the safest and simplest tools available. The bank uses your deposits to fund loans and investments, and in return, it pays you a percentage of your balance — known as interest.

6. Senior Citizen Savings Account

-

Higher interest rates for seniors (usually 60+)

-

May offer additional benefits

Best for: Retirees seeking safer interest income.

7. Joint Savings Account

-

Shared by two or more people

-

Equal access to funds

Best for: Couples, families, or business partners saving together.

8. Children’s / Minor Savings Account

-

Opened by a parent/guardian

-

Encourages saving habits early

Best for: Teaching kids financial responsibility.

9. Specialty Savings Accounts

These are goal-based accounts, such as:

-

Emergency savings

-

Vacation savings

-

Wedding savings

(Some banks allow multiple labeled savings “buckets.”)

Read: Factors that determine foreign exchange Rate of a country

Withdrawal Limits on Checking and Savings Accounts

Understanding withdrawal limits is essential for managing your money efficiently and avoiding unexpected fees. While checking and savings accounts both allow access to your funds, the rules around withdrawals can differ significantly.

Checking accounts are designed for everyday transactions, so they typically offer unlimited withdrawals and transfers. However, there may still be certain limits depending on how you access your money.

1. ATM Withdrawal Limits

Most banks set a daily ATM withdrawal limit, often ranging from $300 to $1,000 per day. The limit is in place to:

-

Reduce fraud risk

-

Protect customers if a debit card is lost or stolen

-

Manage ATM cash availability

Major banks such as JPMorgan Chase and Bank of America allow customers to request higher limits in some cases.

2. Debit Card Purchase Limits

Separate from ATM limits, banks may also cap daily debit card purchases. These limits can be several thousand dollars per day and are typically adjustable upon request.

3. In-Branch Withdrawals

When withdrawing money directly from a bank branch, limits are usually much higher or unrestricted, provided the funds are available.

Withdrawal Limits on Savings Accounts

Savings accounts are designed for saving rather than frequent spending, and historically, they have been subject to stricter rules.

1. Federal Regulation Background

Under a former rule known as Regulation D from the Federal Reserve, savings accounts were limited to six “convenient” withdrawals or transfers per month (such as online transfers or automatic payments).

In 2020, the Federal Reserve removed the mandatory six-withdrawal limit at the federal level. However, many banks still enforce their own limits.

2. Bank-Imposed Limits

Even though the federal rule was lifted, financial institutions may still:

-

Limit certain types of transfers to six per month

-

Charge excess withdrawal fees

-

Convert the account to checking if limits are repeatedly exceeded

Always check your bank’s specific policy.

Types of Withdrawals That May Be Limited

For savings accounts, the following transactions are often counted toward monthly limits:

-

Online transfers

-

Automatic bill payments

-

Phone transfers

-

Overdraft transfers

Transactions are typically not limited:

-

ATM withdrawals

-

In-person withdrawals at a branch

-

Mailed check withdrawals

Checking vs. Savings Accounts: Which Is Better?

The question of whether a checking account or a savings account is “better” doesn’t have a one-size-fits-all answer—it depends on your financial goals and how you use your money. Let’s break it down.

Checking Accounts

- Best For: Everyday spending and bill payments.

- Advantages:

- Unlimited access to funds via debit card, checks, and online transfers.

- Direct deposit for paychecks.

- Convenient for managing cash flow.

- Drawbacks:

- Typically earns little or no interest.

- Overdraft fees can be costly.

- Easier to overspend since funds are always accessible.

Savings Accounts

- Best For: Building financial reserves and long-term savings.

- Advantages:

- Earns interest (higher than checking).

- Encourages saving discipline with withdrawal limits.

- Safe place for emergency funds.

- Drawbacks:

- Limited withdrawals (often capped at six per month).

- Interest rates may not keep up with inflation.

- Less liquid than checking accounts.

Read: Difference Between Memorandum of Association and Articles of Association

Comparison Table

| Feature | Checking Account | Savings Account |

|---|---|---|

| Primary Use | Daily spending | Saving money |

| Access to Funds | Unlimited | Limited |

| Interest Earnings | Low/None | Higher |

| Fees | Possible overdraft, maintenance | Possible withdrawal penalties |

| Best For | Managing cash flow | Building reserves |

Which Is Better?

- If your priority is convenience and daily transactions, a checking account is better.

- If your priority is saving and earning interest, a savings account is better.

- The smartest approach is often to use both together:

- Keep enough in checking for bills and spending.

- Transfer extra funds into savings to grow over time

- How Does Zelle Work? Send And Receive Money - February 16, 2026

- The difference between Checking and Savings Accounts - February 16, 2026

- How to track financial metrics in business - February 13, 2026