Last Updated on February 8, 2026 by admin

Canceling a credit card is a significant financial decision; it’s important to weigh the benefits against the drawbacks before taking action. The first step is to carefully assess your financial situation and long-term goals.

For many cardholders, high annual fees are a major factor. If you’re not fully utilizing the rewards or perks that justify those costs, keeping the card may no longer make sense. Others may choose to cancel as part of a broader effort to reduce debt or simplify financial management.

Closing a card can also help curb overspending. For individuals working with a strict budget or focusing on paying down existing debt, removing access to additional credit may provide discipline and peace of mind.

Shifts in financial priorities often play a role too. Perhaps you originally opened a credit card for travel rewards or cashback benefits, but your lifestyle and spending habits have changed. In that case, switching to a card that better aligns with your current needs could be more beneficial.

Other reasons include dissatisfaction with customer service, unfavorable changes in card terms, or discovering more competitive offers from other issuers.

Canceling a credit card might seem straightforward, but doing it the wrong way can hurt your credit score or leave you with unexpected issues. Here’s a clear guide to help you cancel a card responsibly.

Read: Top 10 Best Banks in the United Kingdom

Things to Consider Before Canceling Your Credit Card

Canceling a credit card isn’t just about cutting it up—it can have lasting effects on your finances and credit profile. Here are the most important factors to weigh before making the decision:

- Impact on Credit Score

- Closing a card reduces your available credit, which can increase your credit utilization ratio.

- It may also shorten the average age of your accounts, both of which can lower your credit score.

- Annual Fees vs. Benefits

- If the card has high annual fees but you’re not using its perks (travel rewards, cashback, insurance), canceling may save money.

- However, if benefits outweigh costs, keeping the card could be smarter.

- Debt Management

- Canceling a card can help reduce the temptation to overspend.

- But if you’re carrying a balance, it’s best to pay it off first to avoid complications.

- Rewards and Points

- Redeem any accumulated rewards before canceling, as most issuers will forfeit unused points once the account is closed.

- Recurring Payments

- Update subscriptions or automatic payments linked to the card to prevent missed bills after closure.

- Customer Service & Terms

- Dissatisfaction with service or unfavorable changes in terms may justify canceling.

- Still, consider whether switching to a no-fee or different card from the same issuer could be a better option.

How to Cancel a Credit Card: A Step-by-Step Guide

Canceling a credit card can be a smart financial move, whether you’re trying to reduce expenses, simplify your finances, or avoid high fees. However, canceling a card incorrectly can negatively affect your credit score. Understanding the right steps can help you close your account safely and confidently.

- Pay Off the Balance

- Make sure the card has a zero balance before canceling.

- If you can’t pay it off immediately, consider transferring the balance to another card with lower interest.

- Redeem Rewards

- Use any cashback, points, or miles before closing the account.

- Once canceled, most issuers will forfeit unused rewards.

- Stop Automatic Payments

- Update subscriptions or recurring bills linked to the card.

- This prevents missed payments after closure.

- Contact the Issuer

- Call customer service or send a written request to cancel.

- Ask for written confirmation that the account is closed at your request.

- Check Your Credit Report

- Verify that the account is listed as “closed at consumer’s request.”

- This ensures your credit history reflects the closure accurately.

- Dispose of the Card Safely

- Cut up or shred the physical card to prevent fraud.

Also read: Factors that determine foreign exchange Rate of a country

Alternatives to Closing a Credit Card Account

Sometimes canceling a credit card isn’t the best option, especially if you’re concerned about your credit score or losing valuable benefits. Fortunately, there are several alternatives that allow you to manage your finances without closing the account entirely.

- Downgrade to a No-Fee Card

- Many issuers, including Chase, Citi, and American Express, allow you to switch to a card with no annual fee.

- This way, you keep your credit history intact while avoiding unnecessary costs.

- Reduce Usage Instead of Canceling

- Simply stop using the card for everyday purchases.

- Keep it open with occasional small charges to maintain activity and avoid account closure by the issuer.

- Negotiate with Your Issuer

- Call customer service to ask about fee waivers, retention offers, or alternative products.

- Issuers often provide incentives to keep you as a customer.

- Consolidate Rewards

- If you have multiple cards with the same issuer, consider transferring points or combining rewards programs.

- This can maximize benefits without needing to cancel.

- Use the Card Strategically

- Keep the card for specific benefits like travel insurance, extended warranties, or fraud protection.

- Even occasional use can justify keeping it open.

- Freeze or Store the Card

- If overspending is a concern, put the card away or freeze it digitally (many banks offer this option).

- This prevents impulse use while preserving your credit line.

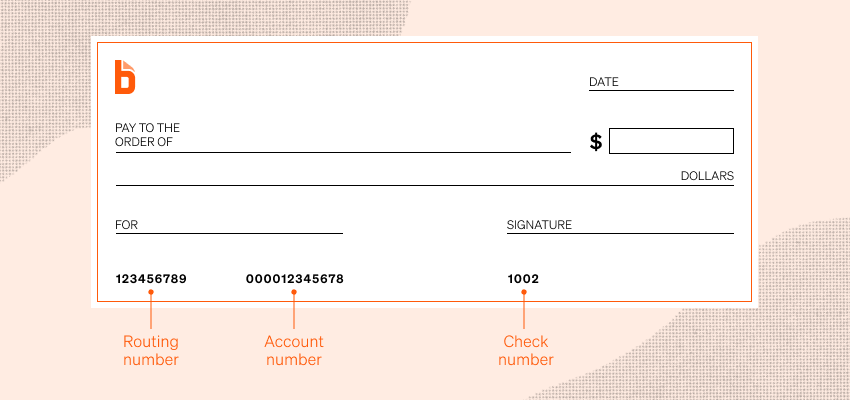

How to Calculate Your Credit Utilization Ratio

Your credit utilization ratio is one of the most important factors in determining your credit score. It shows how much of your available revolving credit (like credit cards) you’re currently using. Lenders use this ratio to assess how responsibly you manage credit.

Formula

Step-by-Step Example

- Card A: Balance = $1,000, Limit = $5,000

- Card B: Balance = $500, Limit = $2,000

- Card C: Balance = $0, Limit = $3,000

Step 1: Add balances

Step 2: Add credit limits

Step 3: Divide balances by limits

Step 4: Convert to percentage

So, your credit utilization ratio is 15%.

You can also read: How to improve your credit score

What to Do After You’ve Canceled Your Credit Card

Canceling a credit card is only part of the process. Once the account is closed, there are a few important steps to take to protect your finances and ensure everything is reported correctly.

- Confirm Closure in Writing

- Request written confirmation from your issuer that the account is closed at your request.

- This protects you if errors appear later on your credit report.

- Check Your Credit Report

- Review your credit report within a month or two to ensure the account is listed as “closed at consumer’s request.”

- Dispute any inaccuracies promptly.

- Redeem Remaining Rewards

- If you didn’t use points or cashback before canceling, check whether you still have access. Some issuers allow redemption for a short period after closure.

- Update Payment Methods

- Make sure subscriptions, bills, or automatic payments linked to the canceled card are switched to another card or account.

- Safely Dispose of the Card

- Cut up or shred the physical card to prevent fraud.

- If it’s a metal card, ask the issuer for instructions on returning or disposing of it.

- Monitor for Residual Charges

- Occasionally, refunds or delayed charges may appear after cancellation. Keep an eye on your statements or contact the issuer to confirm no new activity occurs.

- Reassess Your Credit Strategy

- Consider how canceling affects your credit utilization and account age.

- If you need to rebuild available credit, explore alternatives like opening a no-fee card or requesting a limit increase on another account.

- How Does Zelle Work? Send And Receive Money - February 16, 2026

- The difference between Checking and Savings Accounts - February 16, 2026

- How to track financial metrics in business - February 13, 2026