Last Updated on February 16, 2026 by admin

Zelle is a peer-to-peer (P2P) payment service that allows people to send and receive money quickly using just an email address or mobile phone number. It’s integrated into many major U.S. banks’ mobile apps, making it one of the most widely accessible digital payment platforms.

It’s designed primarily for personal payments like splitting dinner bills, paying rent to a roommate, or sending money to family. Unlike some payment apps that hold funds in a separate wallet, Zelle transfers money directly from one bank account to another.

Zelle is operated by Early Warning Services, LLC, a financial technology company owned by a consortium of major U.S. banks. Unlike Venmo, PayPal, and Cash App, Zelle allows instant transfers without charging an additional fee.

Read: The difference between Checking and Savings Accounts

Advantages and Disadvantages of Zelle

Zelle is a popular peer-to-peer (P2P) payment service in the United States, widely used for transferring funds directly between bank accounts. While it offers several benefits, it also comes with certain drawbacks. Understanding these can help users decide if Zelle is right for them.

Advantages of Zelle

Here are the main advantages of Zelle:

- Instant Transfers Money sent through Zelle typically arrives within minutes, unlike traditional bank transfers that can take hours or days.

- No Fees Zelle does not charge users for sending or receiving money, making it a cost-effective option compared to apps that add transaction fees.

- Wide Bank Integration Zelle is built into many major U.S. banking apps, so you don’t need to download a separate app if your bank supports it. This makes it seamless and convenient.

- Simple Setup You only need the recipient’s email address or phone number to send money—no need for account numbers or routing details.

- Secure Transactions Transfers happen directly between bank accounts, reducing the need for third-party wallets and minimizing exposure to external platforms.

- Trusted for Personal Payments It’s ideal for splitting bills, paying rent, or sending money to friends and family you already know.

Read: How to track financial metrics in business

Disadvantages of Zelle

Here are the main disadvantages of using Zelle:

- Irreversible Transactions Once you send money through Zelle, it’s gone. Payments cannot be canceled unless the recipient hasn’t enrolled yet. This makes accidental transfers or sending to the wrong person risky.

- No Buyer Protection: Unlike PayPal or credit cards, Zelle does not offer purchase protection. If you send money to someone and don’t receive the goods or services, you usually cannot get your money back.

- High Risk of Scams: Zelle has been widely used in fraud schemes. Scammers exploit the instant transfer feature, and banks often deny responsibility, leaving victims without recourse.

- Limited International Use: Zelle only works with U.S. bank accounts. If you need to send money abroad, you’ll need another service.

- Bank Dependency Zelle is tied to participating banks. If your bank doesn’t support it, you may face restrictions or need to use a standalone app with fewer features.

- Potential Security Concerns While Zelle itself is secure, the lack of fraud protection means users bear more responsibility. If your account credentials are compromised, funds can be drained quickly

How Zelle Works

Zelle is a U.S.-based peer-to-peer (P2P) payment service that allows users to send and receive money directly between bank accounts. It is designed for fast, convenient, and secure transactions. Here’s a step-by-step breakdown of how it works:

Zelle is built into many U.S. banking apps and credit union platforms. If your bank supports Zelle, you can access it directly through your mobile banking app without downloading a separate app.

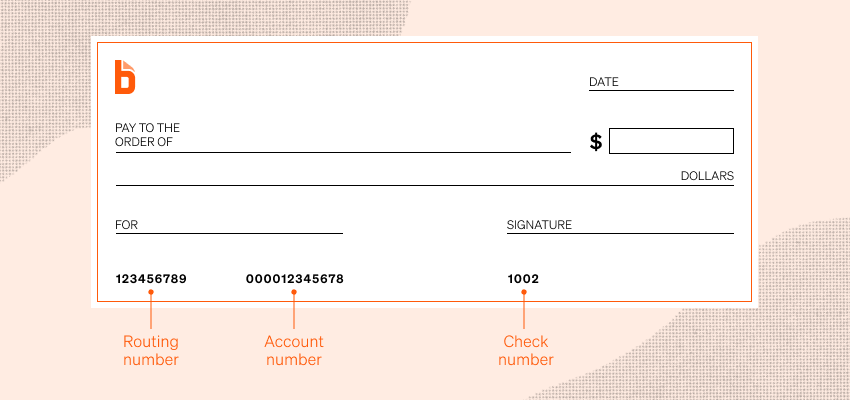

To use Zelle, you link your bank account to your email address or mobile phone number. This acts as your “identifier” for sending and receiving money.

How to Send Money with Zelle

Here’s a clear step‑by‑step guide on how to send money with Zelle:

- Check if your bank supports Zelle

- Zelle is integrated into over 2,300 U.S. banks and credit unions.

- If your bank offers Zelle, you’ll find it inside your mobile banking app. If not, you can download the standalone Zelle app.

- Enroll with Zelle

- Log in to your bank’s mobile app or the Zelle app.

- Register using your U.S. mobile number or email address.

- Choose “Send Money”

- Select Zelle from your bank’s app menu.

- Tap “Send” and enter the recipient’s email or phone number.

- Enter the Amount

- Type in how much you want to send.

- Confirm the details carefully—Zelle transfers are instant and usually cannot be canceled once sent.

- Review and Send

- Double‑check the recipient’s information.

- Hit “Send.” The money typically arrives within minutes directly into the recipient’s bank account.

Read: Annual Percentage Rate (APR):Type, Meaning and How It’s Calculated

- How Does Zelle Work? Send And Receive Money - February 16, 2026

- The difference between Checking and Savings Accounts - February 16, 2026

- How to track financial metrics in business - February 13, 2026