Last Updated on September 6, 2025 by admin

Zelle® has emerged as a popular digital payment platform, enabling users to send and receive money quickly and conveniently through their banking apps. Launched as a solution to streamline peer-to-peer transactions, Zelle® offers seamless integration with many major banks, allowing for instant transfers without the need for cash or checks.

Zelle® which was launched in 2017 by Early Warning Services, LLC, a company owned by some of the big shots in banking, including Bank of America and Wells Fargo.

The aim was to simplify peer-to-peer payments and to make it easier than ever to split the bill for that overpriced brunch with friends. Over time, it has grown to be a staple in the digital payment world, becoming the go-to for millions.

Zelle t allows users to send and receive money using just an email address or a mobile phone number. This is made possible through partnerships with many major banks and credit unions, integrating Zelle® into their mobile banking applications.

To use Zelle®, both the sender and recipient must be enrolled. First, the sender accesses Zelle® either through their bank’s mobile app or the standalone Zelle® app and selects a person from their contacts.

By inputting the recipient’s email or phone number, the sender can initiate the transfer. The funds are then directly withdrawn from the sender’s bank account and sent to the recipient.

If the recipient is already enrolled with Zelle®, the money usually appears in their bank account within minutes, providing near-instantaneous access to transferred funds.

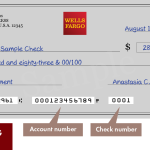

Read: Wells Fargo Routing Number: How to find routing number and how to find it.

Zelle® is a digital payment service that lets you send and receive money quickly between U.S. bank accounts using just an email address or U.S. mobile number. It’s designed for peer-to-peer transfers, meaning you can pay friends, family, or anyone you trust—instantly and without fees

What can you do with zelle

Zelle is a fast, secure, and convenient way to send and receive money directly between U.S. bank accounts—typically within minutes. Here’s what you can do with it:

Send Money Instantly

- Transfer funds to friends, family, or anyone you trust using just their email address or U.S. mobile number.

- No need to share bank account details.

- Works even if the recipient uses a different bank—as long as they’re enrolled with Zelle.

Receive Money

- Once you’re enrolled, money sent to your registered email or phone number goes straight into your bank account—no waiting, no holding.

Request Money

- Need to split a bill or get reimbursed? You can request money from others through your banking app or the Zelle app.

- They’ll get a notification and can pay you instantly.

Split Expenses

- Some banking apps let you split bills with multiple people—perfect for group dinners, shared rides, or weekend getaways.

Pay Trusted Service Providers

- Use Zelle to pay your babysitter, dog walker, or favorite nail tech—just make sure you know and trust the person.

- Zelle is not recommended for buying goods from strangers due to limited fraud protection

Read: Chase Routing Number and how to Use it

How do register for zelle

Registering for Zelle is quick and easy—whether your bank supports it directly or not. Here’s how to get started:

Option 1: Through Your Bank or Credit Union

Many U.S. banks already have Zelle built into their mobile apps or online banking platforms.

- Log in to your bank’s mobile app or online banking.

- Navigate to the Zelle section (usually under “Transfers” or “Send Money”).

- Enter your email address or U.S. mobile number.

- Link your bank account or debit card.

- Verify with a one-time code sent to your email or phone.

- Once enrolled, you can send and receive money instantly using just an email or phone number.

Option 2: Using the Zelle App

If your bank doesn’t support Zelle directly, you can still use it via the standalone app.

- Download the Zelle app from the App Store or Google Play.

- Tap “Sign Up” and enter your name, email, and U.S. mobile number.

- Link a debit card from a U.S. bank account.

- Verify your information with a confirmation code.

- Start sending or receiving money.

- Zelle does not support international transfers or non-U.S. bank accounts.

How to transfer money with Zelle

Transferring money with Zelle is fast, secure, and usually happens within minutes—no cash, no checks, no waiting. Whether you’re using your bank’s app or the Zelle app itself, here’s how to send money

Option 1: Through Your Bank’s Mobile App or Online Banking

Most major U.S. banks (like Chase, Bank of America, Wells Fargo) have Zelle built right in.

- Log in to your bank’s mobile app or online banking.

- Tap “Send Money with Zelle” or go to the Zelle section.

- Add a recipient using their U.S. mobile number or email address.

- Enter the amount you want to send.

- Confirm and send—the money usually arrives in minutes if the recipient is enrolled.

Option 2: Using the Zelle App

If your bank doesn’t support Zelle, you can still use the standalone app.

- Download the Zelle app from the App Store or Google Play.

- Sign up with your U.S. mobile number or email.

- Link a U.S. debit card.

- Tap “Send”, choose a contact or enter recipient info.

- Enter the amount and confirm the transfer

How to receive money with Zelle

Receiving money with Zelle is fast and effortless—once you’re enrolled, the funds typically land in your bank account within minutes. Here’s exactly how to make it happen:

Already Enrolled with Zelle?

If your email address or U.S. mobile number is already registered with Zelle:

- No action needed—the money will be sent directly to your linked bank account.

- You’ll get a notification (via SMS or email) confirming the deposit.

Not Enrolled Yet? Follow These Steps

If someone sent you money but you haven’t enrolled yet:

- Click the link in the payment notification you received.

- Select your bank or credit union from the list.

- Follow the instructions to enroll with Zelle:

- Enter your email or U.S. mobile number

- Link your bank account or debit card

- Verify with a one-time code

- Once enrolled, the money will be deposited directly into your account.

- Make sure the email or phone number the sender used matches the one you enroll with Zelle.

Read:How to register for Wells Fargo Online banking and Mobile App

Which bank works with Zelle?

Zelle® works with over 2,200 banks and credit unions across the U.S., making it one of the most widely supported peer-to-peer payment platforms. If your bank supports Zelle, you can send and receive money directly through your bank’s mobile app or online banking—no separate app needed.

Read: How to contact Wells Fargo Customer Care Service:Phone number & Email address

Zelle Customer Care

If you need help with Zelle®, here’s how to reach their customer support team:

Zelle Customer Care Phone Number

- Call: 1-844-428-8542

- Hours: 8 AM to 10 PM ET, 7 days a week (Closed on New Year’s Day, Independence Day, Thanksgiving, and Christmas)

Online Support

- Visit the Zelle Contact Support page

- You can:

- Report a scam or suspicious activity

- Submit a support request form

- If you’re using Zelle through your bank’s mobile app or online banking, it’s best to contact your bank directly—they handle most Zelle-related issues like enrollment, failed transfers, or account linking.

Comparison zelle with Other Payment Services

Let’s break down how Zelle® stacks up against other major peer-to-peer payment platforms—Venmo, Cash App, and PayPal. Each has its strengths depending on what you’re looking for: speed, security, social features, or global reach.

Zelle vs. Venmo vs. Cash App vs. PayPal

| Feature | Zelle | Venmo | Cash App | PayPal |

|---|---|---|---|---|

| Speed | Instant (bank-to-bank) | 1–3 days (instant for a fee) | Instant or 1–3 days | 1–3 days (instant for a fee) |

| Fees | No fees | Free for debit/balance; 3% for credit | Free for standard; fees for instant/card | Free for bank/balance; fees for card |

| Bank Integration | Built into 2,200+ U.S. bank apps | Standalone app | Standalone app | Standalone app |

| Social Features | None | Social feed, emojis, payment notes | Minimal | None |

| Wallet Functionality | No wallet—direct to bank | Yes (Venmo balance) | Yes (Cash App balance) | Yes (PayPal balance) |

| Business Use | Limited | Business profiles available | Supports business payments | Full merchant tools & global checkout |

| Security | Bank-level encryption | Secure, but less bank-integrated | Secure with optional PIN/biometric | Advanced fraud protection & buyer tools |

| International Support | U.S. only | U.S. only | U.S. only | 200+ countries, 100+ currencies |

- Truist Online Banking And Mobile App, deposit check and customer care - October 3, 2025

- How to contact Investec bank Customer Care via Phone number and email - September 30, 2025

- How to contact Nedbank bank Customer Care via Phone number,& Enbi and email - September 28, 2025