Last Updated on September 15, 2025 by admin

Wire transfers at Wells Fargo offer a convenient and secure way to send money domestically and internationally.

This service is essential for individuals and businesses needing to move funds quickly. At Wells Fargo, the wire transfer process begins by providing the necessary details of the recipient, such as their name, bank account number, and the bank’s routing number.

For international transfers, additional information like the SWIFT or BIC code is required. Users can initiate transfers through Wells Fargo’s online banking platform or by visiting a branch.

While wire transfers are a reliable option for sending large sums of money, they generally come with fees. These fees can vary depending on whether the transfer is domestic or international.

It’s crucial for customers to review these charges before proceeding. Transfers are typically processed on the same business day if initiated early enough, but international transfers might take longer due to varying banking systems and regulations in different countries.

Read: Bank of America wire transfers: type of wire transfer ,limits and charges

How To Initiate wellsfargo Wire Transfer

To initiate a wire transfer with Wells Fargo, you can do it online, in person, or by phone (for some accounts). Here’s a detailed step-by-step guide for each method:

1. Online Wire Transfer (Domestic & International)

Requirements:

-

Must be enrolled in Wells Fargo Online Banking

-

Have the recipient’s complete wire instructions

Steps:

Log in to Wells Fargo Online

-

-

Go to “Transfer & Pay” > “Wire Money”

-

If it’s your first time, you may need to verify your identity and accept wire terms and conditions

-

Click “Add Recipient” and enter:

-

Recipient’s full name and address

-

Recipient’s bank name, address, and routing number (for domestic)

-

SWIFT/BIC code and IBAN (for international)

-

-

Enter the amount, currency, and purpose of the transfer

-

Choose the account to debit

-

Review all details carefully

-

Click “Send” or “Submit” (you may need to enter a code sent to your phone or email)

-

2. In-Person at a Wells Fargo Branch

Steps:

-

Visit any Wells Fargo branch

-

Bring:

-

A valid government-issued photo ID

-

Your Wells Fargo account number

-

Recipient’s wire information

-

-

A banker will help you fill out the wire transfer form

-

You’ll review and sign the authorization

-

The transfer will be processed the same day if submitted before the daily cutoff time

3. By Phone (Business Accounts Only)

-

If you have a business or commercial account, you may be able to initiate wires by phone via a dedicated representative

-

Call the Wells Fargo Business Customer Service line on 1-800-869-3557 to verify eligibility , or visit your local Wells Fargo branch and speak with a banker.

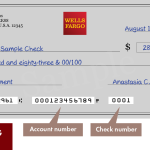

Information You’ll Need for the Wire

For Domestic Wires:

-

Recipient name

-

Recipient address

-

Recipient bank name

-

Recipient bank routing number (ABA)

-

Recipient’s account number

For International Wires:

-

All the above, plus:

-

SWIFT/BIC code of recipient’s bank

-

IBAN (if applicable)

-

Currency type

-

Reason for transfer

Read: Chase wire transfers: type of wire transfer ,limits and charges

Wells fargo Wire Transfer Fees And Costs

Here are the current fees & costs for Wells Fargo wire transfers, including variations by domestic vs international, consumer vs business, and digital vs branch initiation. These are based on the latest available published info — fees may change, so always check your account’s fee schedule.

Wells Fargo Wire Transfer Fee Breakdown

| Type | Consumer Accounts | Business Accounts | Notes / Details |

|---|---|---|---|

| Outgoing Wire – Domestic & International | Digital / Online: $25 In Branch: $40 |

Same fees generally apply for business outgoing wires: ~$25 digital, ~$40 branch | If sending in foreign currency, digital fee might differ/waived depending on currency; exchange rate markups apply. |

| Incoming Wire (Domestic & International) | Consumer receiving: $0 for most domestic or international incoming wires (consumers) | Business receiving: ~ $15 per incoming wire | “Incoming” means the wire is sent to a Wells Fargo account from another bank. Additional fees may apply (intermediary bank fees). |

How to Receive a Wire into Your wells Fargo Account

To receive a wire transfer into your Wells Fargo account, you’ll need to provide the correct wire instructions to the sender. Below are the steps and the exact details you should give them based on whether the wire is domestic or international.

Make sure the sender has all of the following:

For Domestic Wire Transfers (within the U.S.):

- Your full name (as it appears on your account)

- Your Wells Fargo account number

- Routing number:

- Use 121000248 for domestic wires to Wells Fargo

- Your address (linked to your account)

For International Wire Transfers:

- Your full name and address

- Your Wells Fargo account number

- SWIFT/BIC code:

- Use WFBIUS6S for international wires to Wells Fargo

- Bank name and address:

- Wells Fargo Bank, N.A. 420 Montgomery Street San Francisco, CA 94104 United States

Read: How to register for Metro Bank Uk Online Banking and Mobile app & open account

How to send Wells Fargo wire transfer

To send a Wells Fargo wire transfer, you can do it online, in person, or by phone (if pre-authorized). Here’s a clear breakdown of how to get it done

Send a Wire Transfer Online (Consumer or Business)

Log in to your account at wellsfargo.com

- Go to Transfer & Pay and select Wire Money.

- Enroll in wire transfers if it’s your first time.

- Click Add Recipient and enter:

- Recipient’s full name and address

- Bank name and address

- Routing number (domestic) or SWIFT/BIC + IBAN (international)

- Account number

- Choose your funding account, enter the amount, and review fees.

-

-

Currency and amount

-

Purpose of transfer (especially for international wires)

-

-

Select the account you want to send funds from

-

Review details carefully

-

Confirm and submit

- Submit before 3:00 PM Pacific Time for same-day processing

In Person at a Branch

- Visit your nearest Wells Fargo branch.

- Bring recipient and bank details.

- A banker will help you complete the wire.

By Phone

- Only available if you’ve signed a wire transfer agreement at a branch.

- Call Wells Fargo customer service on 1-800-869-3557 to initiate the transfer.

Online wire fees:

-

Domestic: $25

-

International: $25–$45 depending on currency and destination

Wells Fargo wire transfer limits

Wells Fargo wire transfer limits depend on your account type, transaction history, and whether you’re sending domestically or internationally. Here’s a breakdown to guide you

How to Check Your Personal Limit

Via Online Banking

- Log in to wellsfargo.com

- Go to Transfer & Pay > Wire Money

- Your specific limit will be shown before you complete the transfer

Visit a BranchIf your online limit isn’t high enough:

- Go to your nearest Wells Fargo branch.

- Request a limit increase or complete the wire in person.

- Branch transfers often allow higher limits than online

Call Customer Service

- If you’ve signed a wire transfer agreement, you may be able to initiate or inquire about limits by phone.

- Otherwise, they’ll guide you to a branch for verification.

How to Increase Wells Fargo wire transfer Limit

To increase your Wells Fargo wire transfer limit, especially for high-value transactions, here’s what you need to know and do

Visit a Wells Fargo Branch

This is the most direct and effective method:

- Speak with a banker and request a limit increase.

- You may need to provide:

- A valid reason for the increase (e.g., business transaction, property purchase)

- Identification and account verification

- The banker may either raise your digital limit or help you complete the wire in person if it exceeds your current cap

Online Banking Limit Check

- Log in to wellsfargo.com

- Go to Transfer & Pay > Wire Money.

- Your current limit will be displayed before you submit the transfer.

- If the amount exceeds your limit, the system will prompt you to visit a branch

Wells Fargo wire routing number

This number is used for:

- Fedwire transfers (domestic wires)

- FedACH payments

- Receiving international wires (alongside the SWIFT code)

If you’re receiving an international wire, you’ll also need the SWIFT code: WFBIUS6S

Wells Fargo wire transfer Cutoff Times

Here are the cutoff times Wells Fargo uses for wire transfers, based on their “Digital Wires FAQs” and current published info.

These are the times by which you must submit a wire so it can be processed the same business day. If you miss them, it will usually go out the next business day.

| Wire Type | Cutoff Time for Same‑Day Processing |

|---|---|

| Domestic wires | 3:00 PM PT |

| International wires | 2:20 PM PT |

| Wires to another Wells Fargo account (internal/FWO transfers) | 4:30 PM PT |

Type of wells fargo wire transfer

Wells Fargo offers several types of wire transfers to suit different needs—whether you’re sending money across town or across the globe . Here’s a breakdown of the main types:

1. Domestic Wire Transfers

- Purpose: Send money within the United States

- Speed: Typically same-day if submitted before the cutoff (3:00 PM PT)

- Details Needed: Recipient’s name, address, account number, and routing number (ABA)

2. International Wire Transfers

- Purpose: Send money to recipients outside the U.S.

- Speed: Usually 1–3 business days depending on the destination

- Details Needed: Recipient’s name, address, account number, SWIFT/BIC code, and possibly IBAN

3. Wells Fargo ExpressSend® Service

- Purpose: Send money to select countries for cash pickup or direct deposit

- Availability: Limited to specific partner institutions in countries like Mexico, India, and the Philippines

- Benefits: Lower fees and faster delivery compared to traditional international wires

4. In-Branch Wire Transfers

- Purpose: For higher-value or complex transfers

- Limit: Often higher than online limits

- Process: Requires visiting a Wells Fargo branch and verifying identity

- Different types of SBA loans - January 22, 2026

- 50 Biggest Banks in the World - January 21, 2026

- How and ways to Consolidate Credit Card Debt - January 20, 2026